Before entering a Trade check:

-

Euro/Asian Market Currency Strength (check the Dashboard)

-

Calendar News at the Forex Factory or Investing

-

Check for a TREND the currencies pair you are going to enter using MTFA (multiple time frame analyses)

-

Best Time to Trade the Forex Market click here

-

Forex power ALERTS understanding the alerts.

Also read and understand the:

-

Best days to trade Forex click here

-

Money Management click here

-

Best months to trade Forex click here

-

Best months to trade Forex in Portuguese click here

we recommend you have all the PDF files printed so you can easily check before entering a trade.

If you don't understand some of the terms we use, please check our Forex Glossary click here

The 4 quick important things to check before entering a trade.

1-Check for incoming News. Do not enter the trade before news.

2-Check for trend: The best scenario is when H4 and D1 charts agree trending in the same direction you are going to trade.

3-Check the Dashboard for power 6 or 7 negative or positive.

4-Time to enter a trade: The best time to enter a trade is 15 to 20 minutes after the hour. Ex: 9:15, 9:20.

HOW THE BANKS TRADE THE FOREX MARKET Click Here

This is a full article about how the Banks trade the Forex Market click here

Dashboard Analysis:

AUD 1 USD 2 EUR -1 GBP -7 NZD 1 CAD -4 JPY 7 CHF 1

As a general rule, you should always trade the weak against the strong currency. On this example, the GBP is weak showing -7 and the JPY is strong showing 7. As you can see you have narrowed down the charts that needs to be analyzed from the 28 currency pairs to just 2 instantly.

Also, we use on the Dashboard a short way to show the currency pair see it below:

AJ- AUD/JPY

AU- AUD/USD

EA- EUR/AUD

GA- GBP/AUD

AN- AUD/NZD

AF- AUD/CHF

AC- AUD/CAD

UJ-USD/JPY

EU- EUR/USD

GU- GBP/USD

NU- NZD/USD

UC- USD/CAD

UF- USD/CHF

EJ- EUR/JPY

EC- EUR/CAD

EG- EUR/GBP

EN- EUR/NZD

EF- EUR/CHF

GN- GBP/NZD

GJ- GBP/JPY

GC- GBP/CAD

GF- GBP/CHF

NJ- NZD/JPY

NC- NZD/CAD

NF- NZD/CHF

CJ- CAD/JPY

CF- CAD/CHF

FJ- CHF/JPY

Trend Analysis:

- Using a MTFA: Multiple time frame analysis is the inspection of trends, starting with the larger trend and time frames, and working backwards down to smaller time frames.

- To consider a trade the H4 chart has to point in the same direction as the Dashboard power. The best scenario is when H4 and D1 charts are in agreement trending in the same direction you are going to trade.

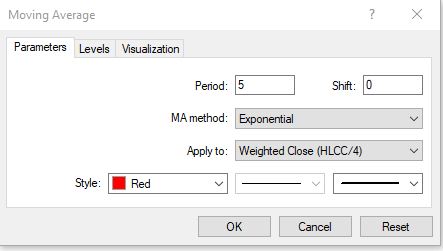

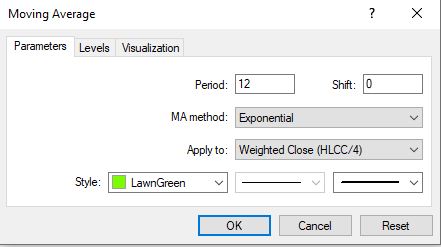

- When the moving average cross over (Green line / Red line) on any time frame is where the trends start. The H4 chart is the minimum trend to consider an entry decision.

To determine the trend, you must use HEINKEN ASHI see VIDEO. Also, this video show how to setup files and profiles.

You can use moving Averages to determine a trend combine with Heinken Ashi

Support & Resistance

Note: We provide Support & Resistance indicators to our customers when they sign-up as VIP Members.

Risk Warning: Trading foreign currencies is a challenging and potentially profitable opportunity for educated and experienced investors. However, before deciding to participate in the Forex market, or using our software, you should carefully consider your investment objectives, level of experience and risk. Most importantly, do not invest money you cannot afford to lose. There is considerable exposure to risk in any foreign exchange transaction. Any transaction involving currencies involves risks including, but not limited to, the potential for changing political and/or economic conditions that may substantially affect the price or liquidity of a currency. The leveraged nature of Forex trading means that any market movement will have an equally proportional effect on your deposited funds. This may work against you as well as for you. The possibility exists that you could sustain a total loss of initial margin funds and be required to deposit additional funds to maintain your position. If you fail to meet any margin call, your position will be liquidated and you will be responsible for any resulting losses.